Influencer Marketing Platform

Unleash the incredible power of creator marketing

The affable.ai platform is now part of the Bazaarvoice solution

As the creator economy takes off, one thing is true: Shoppers trust each other more than they trust what a brand says. Content creators of all sizes on social media are the driving force behind that growth in trust, but with diverse types and areas of expertise, finding the perfect creator who authentically resonates with your consumers is the challenge. The affable.ai platform is now part of the Bazaarvoice solution, the leading technology specializing in AI-driven influencer marketing solutions. Let us help you connect, manage, and measure creator collaborations for your brand.

Find and manage influencers with Bazaarvoice

Find all your creators in one place

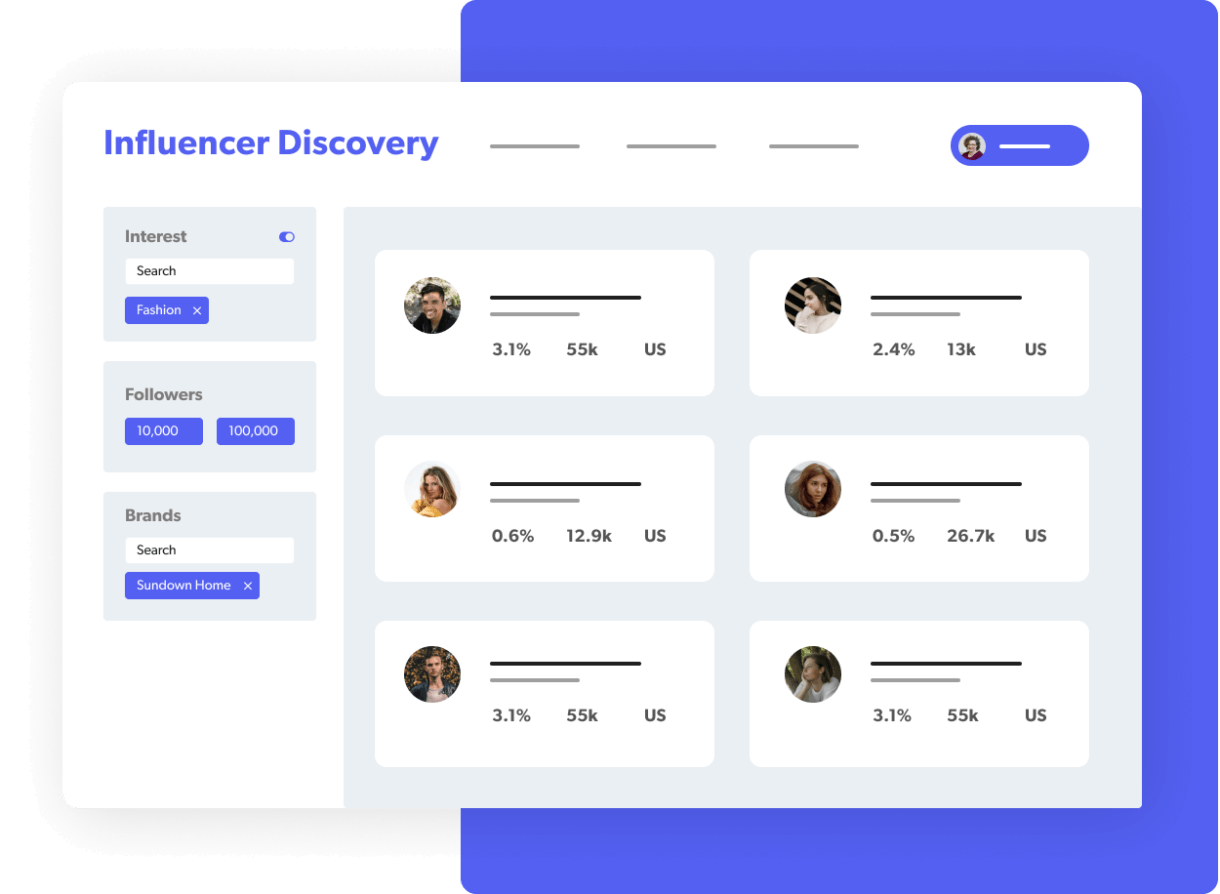

Discover the ideal creators for your marketing strategy with Bazaarvoice affable.ai, our newest solution.

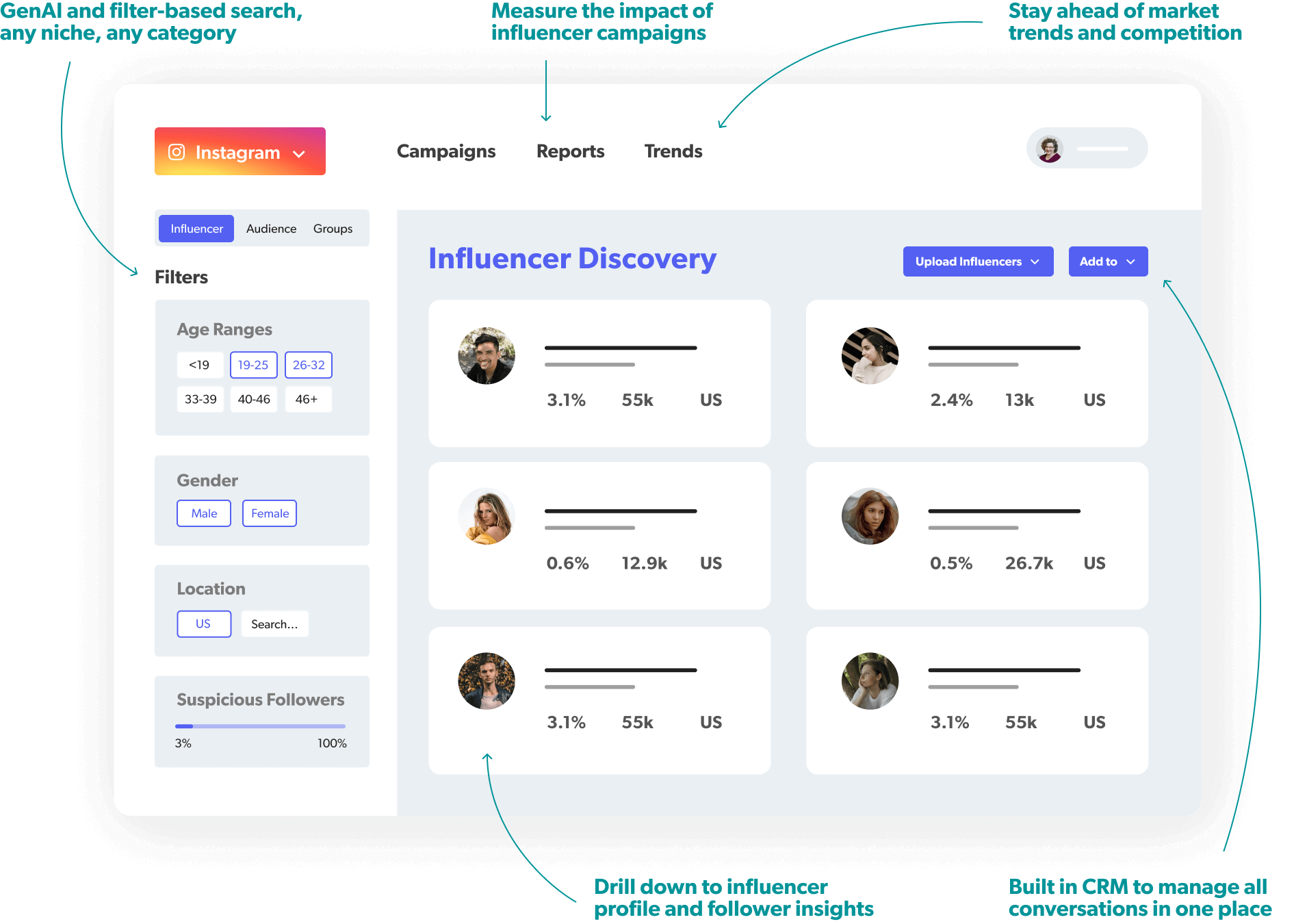

Use 20+ advanced filters or simplify creator search with our GenAI offering with text, mood boards, conversational chat, and lookalike recommendations. Whether you’re looking for a nano creator with followers in the thousands or macro influencers with 250K+ followers, collaborate and manage your creators seamlessly from one place, with an option to skip over any of your competitors’ creators.

Bonus: Explore our creator marketing solutions for agencies – raise your client’s social voice with scalable creator marketing.

Four power-packed modules. One easy-to-use AI-driven platform.

Manage collaborations

Track campaigns

Measure performance

We would highly recommend affable.ai for its insights on creators and tracking and reporting capabilities. The process is a lot easier and more convenient in getting details such as engagement rate and reach of creators, which helps us curate our content more efficiently.

Celisse Ng

Marketing Manager, L’Occitane

The Bazaarvoice affable.ai advantage

Automate and consolidate the management of creators, to build your influencer army

Monitor competitor influencer trends and stay ahead of the curve

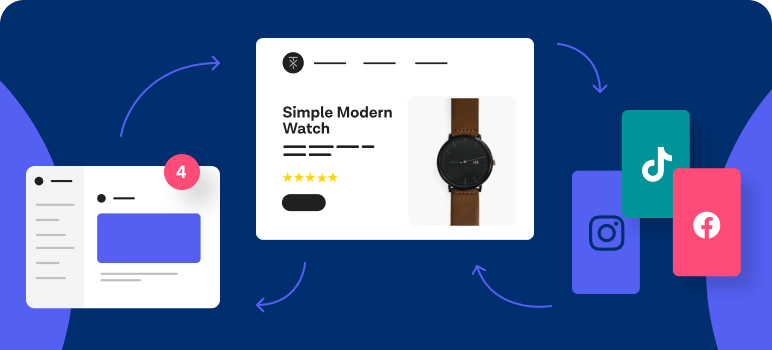

Integrate seamlessly with your communication, e-commerce, and social media applications

Seamlessly manage influencer gifting and product seeding at scale

Automate affiliate recruitment, tracking and payment

Let us do the heavy lifting with creator partnership services

Say goodbye to guesswork

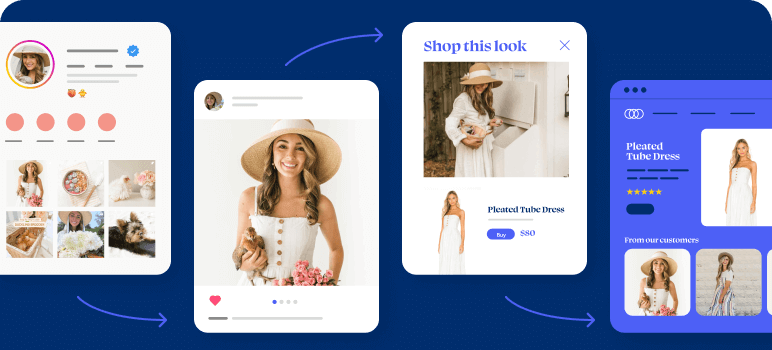

One dashboard to view all the influencer generated content.

Get started

Get in touch to find out which solutions will make the most impact for your business. Our helpful sales team can answer your questions and talk about everything from set up to ROI.

Book a call